sites-crimea.ru Learn

Learn

Best Term For Life Insurance

You're able to select a term policy for a period of time that works best for your needs, such as 10, 20, or 30 years. Term life is affordable and your. Term Life insurance is temporary life insurance, with a guaranteed, income tax-free death benefit, that can make it simple to protect your loved ones for a. Affordable. Term life insurance is the most cost-effective way to provide death benefit protection for your family for a set number of years. It offers a death benefit without any cash value buildup. Coverage lasts for the term specified in the policy, and once the term ends, the coverage expires. Coverage could start for less than $15 per month for a healthy young adult who doesn't smoke. Who is term life insurance best suited for? Term life insurance. Best term life insurance · Best for flexibility: Guardian Life Insurance · Best for discounts: Amica · Best large insurer: Northwestern Mutual · Best for. Guardian is 99, NYL and NWM are Term Life Insurance offers coverage at a price that makes sense for a monthly budget. This could mean additional financial stability for your family in the. Term life is a good choice if you want to ensure your spouse or dependents are protected against large debts or expenses, such as a mortgage or child care, by a. You're able to select a term policy for a period of time that works best for your needs, such as 10, 20, or 30 years. Term life is affordable and your. Term Life insurance is temporary life insurance, with a guaranteed, income tax-free death benefit, that can make it simple to protect your loved ones for a. Affordable. Term life insurance is the most cost-effective way to provide death benefit protection for your family for a set number of years. It offers a death benefit without any cash value buildup. Coverage lasts for the term specified in the policy, and once the term ends, the coverage expires. Coverage could start for less than $15 per month for a healthy young adult who doesn't smoke. Who is term life insurance best suited for? Term life insurance. Best term life insurance · Best for flexibility: Guardian Life Insurance · Best for discounts: Amica · Best large insurer: Northwestern Mutual · Best for. Guardian is 99, NYL and NWM are Term Life Insurance offers coverage at a price that makes sense for a monthly budget. This could mean additional financial stability for your family in the. Term life is a good choice if you want to ensure your spouse or dependents are protected against large debts or expenses, such as a mortgage or child care, by a.

Term life insurance covers a specific time period and provides financial help to the beneficiary. Often this money is used to replace income that's lost due to. If you stop paying premiums, the insurance stops. Term policies pay benefits if you die during the period covered by the policy, but they do not build cash. Yearly renewable term, once popular, is no longer a top seller. The most popular type is now year term. Most companies will not sell term insurance to an. If you're concerned about finding an affordable life insurance policy that's easy to qualify for, consider getting a policy from Lincoln Heritage Life Insurance. To get a better feel for how term life insurance works, you can start by using our calculator to get a no-commitment quote for a 20 year term life policy. Term life an affordable option. Term life insurance provides death protection for a stated time period, or term. Since it can be. Term life insurance policies typically range from years. The amount of coverage you need and the term life insurance length will depend on your unique. The best type of life insurance is called term life insurance (also called pure life insurance), and it guarantees a death benefit if you (the insured) die. Term life insurance. Helps provide financial protection for a specific period of time (e.g. 10, 15, 20 or 30 years) The best type of life insurance for you depends on your budget and your needs. Types of life insurance · Term life insurance · No-medical-exam life insurance. Term life insurance provides coverage for a specific period of time, or "term" of years. If the insured person dies within the "term" of the policy and the. We reviewed the top term life insurance companies based on coverage options, riders, online accessibility, customer service, financial strength, and more. Term life insurance offers more affordable coverage than whole life. However, it only lasts for a limited number of years, and it doesn't provide the. Term life insurance policies typically come in , , and year terms Your financial professional can help you weigh your options and find the best. Term life insurance. Helps provide financial protection for a specific period of time (e.g. 10, 15, 20 or 30 years) Term life insurance covers you for a set period of time (usually 10, 15, or 20 years), at a cost that might be lower than long-term protection (which offers. Our Top Rated Life Insurance Companies. If you stop paying premiums, the insurance stops. Term policies pay benefits if you die during the period covered by the policy, but they do not build cash. Think of term life insurance as “basic” coverage, providing financial protection for a set number of years. It's an affordable solution when you may not. Term life insurance covers a specific time period and provides financial help to the beneficiary. Often this money is used to replace income that's lost due to.

Usd Npr

USD to NPR Chart. +%. (1Y). US Dollar to Nepalese Rupee. 1 USD = NPR. Use the NPR to USD currency converter at sites-crimea.ru for accurate and up-to-date exchange rates. Easily convert Nepalese Rupees to US Dollars with. Download Our Currency Converter App ; 1 USD, NPR ; 5 USD, NPR ; 10 USD, 1, NPR ; 20 USD, 2, NPR. Boost your Profits with IFCM Invest · Trading · Currency Converter · Convert Nepalese rupee to Dollar · NPR to USD. USD/NPR Live Rate & Expert Analysis: Interactive Charts, Latest News & Insights on the US Dollar - Nepalese Rupee Dynamics. Discover What Drives the Pair. This page provides the most accurate information on US Dollar (USD) to Nepalese Rupee (NPR) exchange rate history. View complete USD to NPR historical data. Current exchange rate US DOLLAR (USD) to NEPAL RUPEE (NPR) including currency converter, buying & selling rate and historical conversion chart. Learn the current USD to NPR exchange rate and the cost when you send money to Nepal with Remitly. 1 USD To NPR Convert United States Dollar To Nepalese Rupee. 1 USD = NPR Aug 25, UTC. Send Money. Check the currency rates against all. USD to NPR Chart. +%. (1Y). US Dollar to Nepalese Rupee. 1 USD = NPR. Use the NPR to USD currency converter at sites-crimea.ru for accurate and up-to-date exchange rates. Easily convert Nepalese Rupees to US Dollars with. Download Our Currency Converter App ; 1 USD, NPR ; 5 USD, NPR ; 10 USD, 1, NPR ; 20 USD, 2, NPR. Boost your Profits with IFCM Invest · Trading · Currency Converter · Convert Nepalese rupee to Dollar · NPR to USD. USD/NPR Live Rate & Expert Analysis: Interactive Charts, Latest News & Insights on the US Dollar - Nepalese Rupee Dynamics. Discover What Drives the Pair. This page provides the most accurate information on US Dollar (USD) to Nepalese Rupee (NPR) exchange rate history. View complete USD to NPR historical data. Current exchange rate US DOLLAR (USD) to NEPAL RUPEE (NPR) including currency converter, buying & selling rate and historical conversion chart. Learn the current USD to NPR exchange rate and the cost when you send money to Nepal with Remitly. 1 USD To NPR Convert United States Dollar To Nepalese Rupee. 1 USD = NPR Aug 25, UTC. Send Money. Check the currency rates against all.

Note: Under the present system the open market exchange rates quoted by different banks may differ. Currency, Unit, Buy, Sell. usd (U.S. Dollar). 1. Click in the calculator widget to select USD and NPR as the currencies you want to exchange. 3. Get great rates. Revolut always offers great exchange rates. Today's best Nepalese rupees - US dollar exchange rates. Mid-market exchange rate. 1 NPR = USD. Convert USD to NPR using live exchange rates. Convert Dollars to Nepalese Rupees - Exchange Calculator August Find the current US Dollar Nepalese Rupee rate and access to our USD NPR converter, charts, historical data, news, and more. US dollar (USD) Nepalese rupee (NPR) exchange rate · Is it the right time to change your currencies? · Historical US dollar / Nepalese rupee · Currency Of United. NEPALESE RUPEE - NPR; NETHERLAND ANTILLE GUILDER - ANG; NEW ZEALAND DOLLAR UNITED STATES DOLLAR - USD; URUGUAY PESO - UYU; UZBEKISTAN SUM - UZS; VANUATU. This is the US dollar (USD) to Nepalese rupees (NPR) exchange rate history summary page, detailing 5 years of USD and NPR historical data from to Convert US dollars USD to Nepalese rupees NPR. Use Alpari's converter to quickly and conveniently make currency conversions online. Get the latest Nepalese Rupee to United States Dollar (NPR / USD) real-time quote, historical performance, charts, and other financial information to help. Convert USD to NPR. Join 45+ million Revolut customers today and convert US Dollars to Nepalese Rupees at great exchange rates. Amount. USD. $1, Find the latest USD/NPR (USDNPR=X) stock quote, history, news and other USD/NPR (USDNPR=X). Follow. (%). At close: August 23 at. Instarem allows you to convert USD to NPR at live rates. The rate given to you reflects the current market rate with minimal margins and no hidden fees to. Get free real-time information on USD/NPR quotes including USD/NPR live chart. Get US Dollar/Nepalese Rupee FX Spot Rate (USDNPR=X) real-time currency quotes, news, price and financial information from Reuters to inform your trading. Get free historical data for the USD NPR (US Dollar Nepalese Rupee) currency pair, viewable in daily, weekly or monthly time intervals. Discover historical prices for USDNPR=X stock on Yahoo Finance. View daily, weekly or monthly format back to when USD/NPR stock was issued. NPR, USD, NPR, USD, NPR, USD. ,», , 1,,», , 4,,», ,», , 2,,», , 5,,», ,», , 2,,», Find the latest USD/NPR (USDNPR=X) stock quote, history, news and other vital information to help you with your stock trading and investing. Nepal Exchange Rate against USD averaged (USD/NPR) in May , compared with USD/NPR in the previous month.

T Stock Price History

Stock price history for AT&T (T) Highest end of day price: $ USD on Lowest end of day price: $ USD on AT&T Inc. (sites-crimea.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock AT&T Inc. | Nyse: T | Nyse. Find the latest historical data for AT&T Inc. (T) at sites-crimea.ru View historical data in a monthly, bi-annual, or yearly format. T Stock's Price Graph & Average Annual Return; Performance of AT&T Inc (T) Stock Compared to the Overall Stock Market; Top 10 Largest Single-Day Gains; Top Find the latest historical data for AT&T Inc. (T) at sites-crimea.ru View historical data in a monthly, bi-annual, or yearly format. Stock Price Information. Stock Quote. Truist Financial Corporation. ERROR: unable to load widget: error undefined. Stock Chart. Find the latest AT&T Inc. (T) stock quote, history, news and other vital information to help you with your stock trading and investing. Historical stock closing prices for AT&T Inc. (T). See each day's opening price, high, low, close, volume, and change %. Closing prices ; Nov 18, · ; Nov 17, · ; Nov 16, · ; Nov 15, · ; Nov 14, · Stock price history for AT&T (T) Highest end of day price: $ USD on Lowest end of day price: $ USD on AT&T Inc. (sites-crimea.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock AT&T Inc. | Nyse: T | Nyse. Find the latest historical data for AT&T Inc. (T) at sites-crimea.ru View historical data in a monthly, bi-annual, or yearly format. T Stock's Price Graph & Average Annual Return; Performance of AT&T Inc (T) Stock Compared to the Overall Stock Market; Top 10 Largest Single-Day Gains; Top Find the latest historical data for AT&T Inc. (T) at sites-crimea.ru View historical data in a monthly, bi-annual, or yearly format. Stock Price Information. Stock Quote. Truist Financial Corporation. ERROR: unable to load widget: error undefined. Stock Chart. Find the latest AT&T Inc. (T) stock quote, history, news and other vital information to help you with your stock trading and investing. Historical stock closing prices for AT&T Inc. (T). See each day's opening price, high, low, close, volume, and change %. Closing prices ; Nov 18, · ; Nov 17, · ; Nov 16, · ; Nov 15, · ; Nov 14, ·

Complete AT&T Inc. stock information by Barron's. View real-time T stock price and news, along with industry-best analysis Trustbusting Has a Long History. View the T premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the AT&T Inc real time stock. Discover historical prices for T stock on Yahoo Finance. View daily, weekly or monthly format back to when AT&T Inc. stock was issued. Historical Stock Information, Quote, Common Dividends, Preferred Dividends, Quote, Stock Splits, Other Corporate Actions. 35 minutes ago. Historical Stock Information, Quote, Common Dividends, Preferred Dividends, Quote, Stock Splits, Other Corporate Actions, WarnerMedia Transaction, AT&T Corp. Results for Friday, August 30, ; $ Closing Price ; 12,, Volume ; $ Day's High ; $ Day's Low ; Split Adjustment. The 52 analysts offering price forecasts for AT&T have a median target of , with a high estimate of and a low estimate of TNew York Stock Exchange • NLS real time price • USD. AT&T INC. (T). at close. + (+%). Summary Financials Analysis Earnings Investors Sentiment. Price History. Bank of America Corporation. New York Stock Exchange: BAC. Change chart type. Adjusted: Splits and Dividends. The all-time high AT&T stock closing price was on November 18, · The AT&T week high stock price is , which is % above the current share. AT&T Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time T stock price. AT&T - 40 Year Stock Price History | T · The all-time high AT&T stock closing price was on November 18, · The AT&T week high stock price is AT&T stock (symbol: T) underwent a total of 4 stock splits. The most recent stock split occurred on April 11th, Stock Quote & Chart ; Today's Open. ; Previous Close. ; Intraday High. ; Intraday Low. ; 52 Week High. AT&T Inc T:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/02/24 · 52 Week Low · 52 Week Low Date10/06/. stock split. The following chart shows T's dividend growth rate over the last decade: The Bottom Line. T is one of the most popular and heavily-traded stocks. Options Overview Details · Implied Volatility % (%) · Historical Volatility % · IV Percentile 10% · IV Rank % · IV High % on 10/06/23 · IV. A definitive take on AT&T stock as it trades higher after earnings. Here's what investors should consider when looking at the telecommunications giant. Price History & Performance ; Current Share Price, US$ ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta,

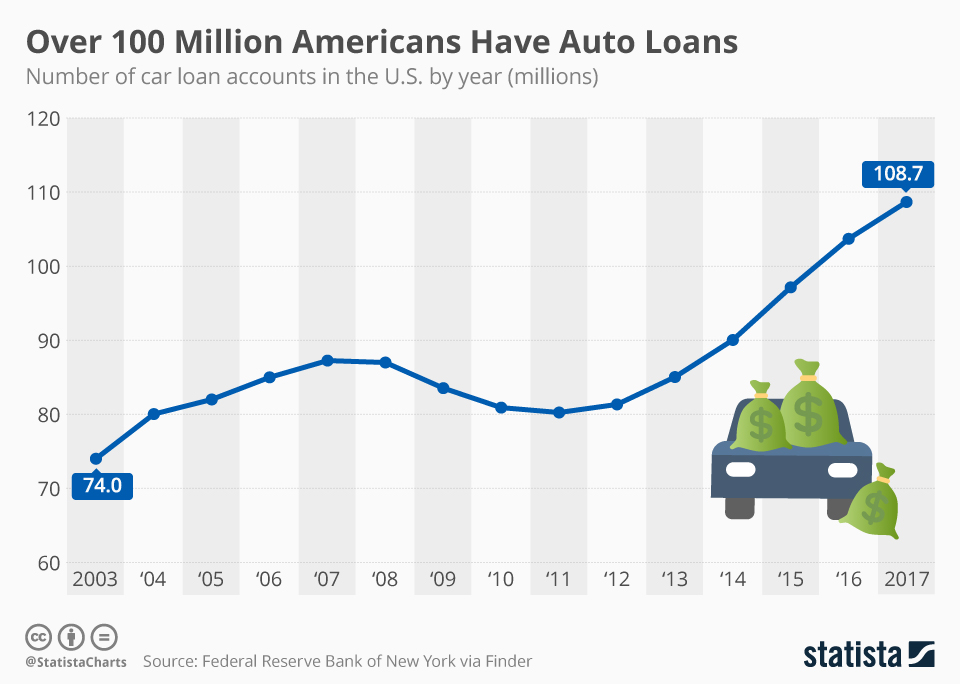

Used Car Interest Rates Now

* Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Classic cars add 2 percentage points to the oldest rates. Terms and rates will vary on loans for business purposes. Payment example: car loan with used model. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. Used Purchase Auto Loans · Interest rates as low as % APR* · Financing terms up to 84 Months · Pre-qualification with no credit impact. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Auto Loan Rates ; New Auto , %, %, %, % ; Used Auto , %, %, %, % ; Used Auto , %, %, %, -. Fast Application, Competitive Rates And Quick Decisions. Apply for a new or used car loan or refinance your existing auto loan at Bank of America. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Classic cars add 2 percentage points to the oldest rates. Terms and rates will vary on loans for business purposes. Payment example: car loan with used model. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. Used Purchase Auto Loans · Interest rates as low as % APR* · Financing terms up to 84 Months · Pre-qualification with no credit impact. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Auto Loan Rates ; New Auto , %, %, %, % ; Used Auto , %, %, %, % ; Used Auto , %, %, %, -. Fast Application, Competitive Rates And Quick Decisions. Apply for a new or used car loan or refinance your existing auto loan at Bank of America.

Auto Loan Rates ; New Auto , %, %, %, % ; Used Auto , %, %, %, % ; Used Auto , %, %, %, -. Auto Loan Rates ; to % ; to % ; to % ; to % ; to %. Resources ; New Vehicle Loan. Rates as low as % APR · Guaranteed Asset Protection available. For vehicles model years and Newer ; Used Vehicle Loan. Rates. Get on the road with low interest rates ; Model Year, 66 Months, % APR ; Model Year, 72 Months, % APR ; Model Year, 78 Months, Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. Rates as low as % APR.¹skip to disclosure · Today's new and used auto rates · estimate your monthly paymentskip to disclosure · What type of vehicle are you. Get pre-approved auto loans from Apple FCU so you can focus on the actual selling price rather than keeping track of the interest rate. Apply Now! Used Auto Loan Rates ; 48 months, %, $ ; 60 months, %, $ ; 72 months · %, $ ; 84 months · %, $ Auto Loan Rates (used) ; Months, %% ; Months, %% ; Months, %% ; Months, %%. * Used Vehicle Loans - As low as % APR (Annual Percentage Rate) is our best auto loan rate on approved credit and up to % financing on Used Vehicle. LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · % ; Alliant Credit Union – Used car. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. Finance Your Next Car With Us ; %, Up to 36 · $ (at 36 months) ; %, 37 - 48 · $ (at 48 months) ; %, 49 - 66 · $ (at 66 months) ; %, 67 -. New & Used Auto* ; Eligible Borrowers Only. 76 to 84 Months, · $, $, Max ; Used Up to 66 Months, · $, $, Max. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. Rates as of Sep 04, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Used Automobile Loans ; Up to 75 Months (Model Years & Newer, Amounts Equal to or Greater Than $15,, Max Mileage 75,), %, %*** ; Up to New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. In Q3 average car payment for used cars is almost $ monthly and 12% interest most buyers choose months. New cars or Used Auto rates starting at % APR (Annual Percentage Rate) effective 06/07/; subject to change without notice. Patelco offers a range of base rates and.

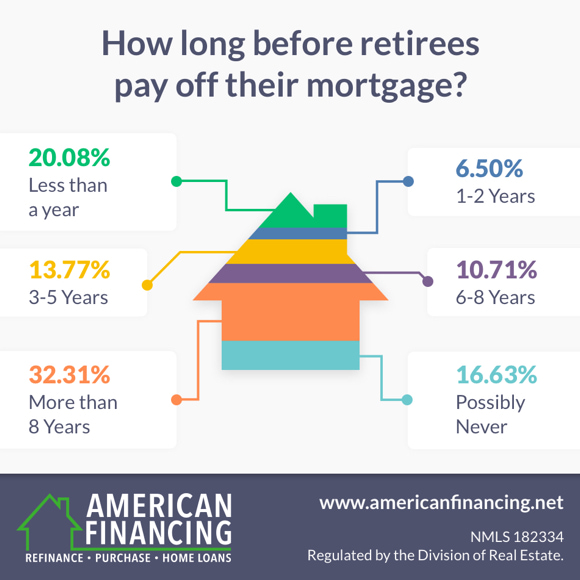

Retiring With A Mortgage

If you're near retirement or already retired, later life mortgages are an alternative to a standard mortgage that might be right for you. You need to be aged If you expect to carry your mortgage into retirement, refinancing now could reduce your monthly mortgage payments, which would be a big help when your income. It's almost always a good idea to start saving early. Why? Because the longer you save, the more your money will grow. This is thanks to compound interest. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. 44% of to year-old homeowners are carrying mortgage into retirement, and 32% expect it will take them more than eight years to pay it off. Is it better to pay off your house or save for retirement? There's no simple answer. In fact, what you choose depends on your economic situation. You want to save on interest payments: Depending on a home loan's size, interest rate, and term, the interest can cost hundreds of thousands of dollars over the. Key Takeaways · Paying off your mortgage eliminates a major monthly expense in retirement, reducing the income you'll need. · Retiring with a mortgage means. A bank advisor tells a Just retired woman who's wondering if using investments to pay off a mortgage is not a good idea. If you're near retirement or already retired, later life mortgages are an alternative to a standard mortgage that might be right for you. You need to be aged If you expect to carry your mortgage into retirement, refinancing now could reduce your monthly mortgage payments, which would be a big help when your income. It's almost always a good idea to start saving early. Why? Because the longer you save, the more your money will grow. This is thanks to compound interest. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. 44% of to year-old homeowners are carrying mortgage into retirement, and 32% expect it will take them more than eight years to pay it off. Is it better to pay off your house or save for retirement? There's no simple answer. In fact, what you choose depends on your economic situation. You want to save on interest payments: Depending on a home loan's size, interest rate, and term, the interest can cost hundreds of thousands of dollars over the. Key Takeaways · Paying off your mortgage eliminates a major monthly expense in retirement, reducing the income you'll need. · Retiring with a mortgage means. A bank advisor tells a Just retired woman who's wondering if using investments to pay off a mortgage is not a good idea.

Many people retire with a mortgage. Low mortgage rates, recent refinancing, or lack of resources to pay off the debt are several reasons why. A Harvard. Choosing whether to pay off your mortgage before retirement depends heavily on personal financial circumstances, risk tolerance, and future goals. Types of Loans for Retirement · HECM Home Loan — The HECM proceeds from the equity in your current home is available when you need it and can help you pay bills. Another positive to withdrawing retirement funds early is avoiding the need to pay private mortgage insurance (PMI)An insurance policy that protects the lender. Step 1: Stop making assumptions. Clear away your bias of client life as it relates to debt. Make sure you are not avoiding the questions for your retired or. Carrying a mortgage into retirement allows individuals to tap into an additional stream of income by reinvesting the equity from a home. The other benefit is. The average monthly retirement income in California in was $2,, according to the U.S. Census Bureau. In our second set of data, we. When interest rates are low, you may be better off putting potential "extra" mortgage payments into a retirement account that holds stock or bond investments. Yes, definitely if you can. When you retire your income will probably be lower and the mortgage interest may not be high enough to qualify for a. When interest rates are low, you may be better off putting potential "extra" mortgage payments into a retirement account that holds stock or bond investments. Whether it makes financial sense for retirees or those nearing retirement to pay off their mortgages depends on factors such as income, mortgage size, savings. If you haven't yet retired and have access to cash through savings or investments, it might be worthwhile making overpayments on your mortgage in the run up to. Mortgage payments can suck your retirement savings dry every month. They can keep you from spending money on the very things that made you want to retire in. If you pay off the mortgage now, in 10 years your savings will be $, The earnings rate on your savings would have to rise above 6% within the next few. Some lenders have set an age limit for new mortgage applications at 65 to 70 years old. With Lloyds Bank, there are age limits on when your mortgage must be. It's a safe decision. There are no surprises. You won't have a mortgage payment in retirement, even though you feel like you can handle that expenditure during. The author does a great job of framing the use of reverse mortgages as part of an overall retirement strategy for generating income in retirement. The book is a. Or, if you are comfortable with carrying a mortgage for a few more years into your retirement, consider refinancing your mortgage at a lower interest rate or. Once you retire, you don't have access to the full income you earned when you were working. This makes you a riskier candidate for a mortgage loan. Your lender. Your home is not included as an asset in the Age Pension assets test. Learn how paying off your mortgage can affect your pension!

Trading Options In Ira

How options settle · Buying an option. You must have enough money in your settlement fund to cover your purchase when you place an order. · Selling an option. The. Choose from thousands of mutual funds, exchange-traded funds (ETFs), individual equities and fixed-income securities Professional account management. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. Learn about the two option types available to investors: calls and puts. Find out more about options trading with an Ameriprise Financial advisor. Trade within your IRA across stocks, options, and futures. Open Account Options trading is not suitable for all investors. Your TradeStation. Options are contracts that offer investors the potential to make money on changes in the value of, say, a stock without actually owning the stock. Of course. You can trade options in most IRAs provided they request the right settings. This includes Traditional, Rollover, Roth, Simple, and SEP IRAs. Requirements for Futures Trading in an IRA · Standard CME Futures contracts & Options on Futures: Start of Day Net Liq must be $25, · Smalls, CME Micro E-mini. It's not a good idea, unless you are a super skilled options trader. That is maybe 5–10% of all traders. Do the math. Are you one of those? How options settle · Buying an option. You must have enough money in your settlement fund to cover your purchase when you place an order. · Selling an option. The. Choose from thousands of mutual funds, exchange-traded funds (ETFs), individual equities and fixed-income securities Professional account management. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. Learn about the two option types available to investors: calls and puts. Find out more about options trading with an Ameriprise Financial advisor. Trade within your IRA across stocks, options, and futures. Open Account Options trading is not suitable for all investors. Your TradeStation. Options are contracts that offer investors the potential to make money on changes in the value of, say, a stock without actually owning the stock. Of course. You can trade options in most IRAs provided they request the right settings. This includes Traditional, Rollover, Roth, Simple, and SEP IRAs. Requirements for Futures Trading in an IRA · Standard CME Futures contracts & Options on Futures: Start of Day Net Liq must be $25, · Smalls, CME Micro E-mini. It's not a good idea, unless you are a super skilled options trader. That is maybe 5–10% of all traders. Do the math. Are you one of those?

This article will explore how option trading works and explain how using a Self-Directed IRA can serve as a savvy tax advantage. PTI accepts nearly all Index and Stock Option trades, including: Short Equity Puts (% cash secured), SEP IRAS, Rollovers, Roth IRAs accepted. You can invest in mutual funds, ETFs, stocks, bonds, and more. You can even select mutual funds created specifically for retirement. Target Retirement Funds. Stocks and options; Mutual funds and exchange-traded funds, or ETFs; Bonds and CDs; Fractional shares through Schwab Stock Slices™; Target date retirement funds. Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Trading index options · Timing matters with Long-Term Equity Anticipation Securities · Using put options to offset gains · Trading options in an IRA · Trading. Is an IRA a Brokerage Account? No. Brokerage accounts are distinct from IRAs in several ways. For example, some brokerage accounts may not charge fees to open. Day Trade Minimum Equity: If the equity in your IRA falls below $25, at any point, a day trade minimum equity call will be issued. Until you add more funds. $0 option trades are subject to a $ per-contract fee. Sales are subject to a transaction fee of between $ and $ per $1, of principal. There are. Manage your investments with convenience · Enter trades for stocks, no load mutual fundsFootnote 3, exchange-traded funds, options and money market mutual funds. Retirement · IRA overview · IRA contributions · IRA contribution adjustments · IRA withdrawals · Transfers and rollovers · Robinhood IRA Transfers Gold Match. TDAmeritrade is by far the best especially if you wanna do stuff like trading options on a roth IRA because if you really wanna get everything. This conservative approach to trading options can produce additional revenue, regardless of whether the stock price rises or falls, as long as the proper. Apply for the ability to trade options in your brokerage account or IRA. The Power E*TRADE Paper Trading application simulates financial markets and the. An "Iron Condor" is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Trading. IRAs cannot be enabled for margin trading, which prevents you from using certain options strategies. For example, if you sell short puts, they. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. With a Principal IRA, you'll choose from a range of investment options such as mutual funds, stocks, bonds, and exchange-traded funds. Options still have their uses in a Roth IRA. They can, for example, provide a way for an investor to hedge against an expected market correction without selling. Futures Trading Platforms: · Commissions: · Low Day Trading Margins: · Advanced Technology: · Multiple Clearing Options: · Broker Assisted Programs.

Investment That Can Make You Rich

“Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons Enhanced. How To Get Rich: 8 Tips For Building Wealth · 1. Establish Financial Goals · 2. Destroy Your Debt · 3. Create a Cushion · 4. Start Investing Now · 5. Diversify Your. Let us take a look at how investors can make the most of stock markets to become rich through long-term wealth creation. Investing is an effective way to put your money to work and potentially build wealth. Only you can decide how much risk you're willing to take for the. If markets are trending upward, it makes sense to implement a strategic asset allocation as soon as you can. History shows that investors taking such a risk. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. 2. Cash. All the super-wealthy investors will have a percentage of their investment portfolio in cash — generally around 10%. · 3. Long-Term Investments. Long-. While bonds steady your portfolio, smart stock investments are your opportunity to build wealth quickly. Stocks are riskier investments, but you can mitigate. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons Enhanced. How To Get Rich: 8 Tips For Building Wealth · 1. Establish Financial Goals · 2. Destroy Your Debt · 3. Create a Cushion · 4. Start Investing Now · 5. Diversify Your. Let us take a look at how investors can make the most of stock markets to become rich through long-term wealth creation. Investing is an effective way to put your money to work and potentially build wealth. Only you can decide how much risk you're willing to take for the. If markets are trending upward, it makes sense to implement a strategic asset allocation as soon as you can. History shows that investors taking such a risk. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. 2. Cash. All the super-wealthy investors will have a percentage of their investment portfolio in cash — generally around 10%. · 3. Long-Term Investments. Long-. While bonds steady your portfolio, smart stock investments are your opportunity to build wealth quickly. Stocks are riskier investments, but you can mitigate.

An individual retirement account (IRA) lets you build wealth and retirement security. The money you invest in an IRA grows tax-free until you retire and are. Pay Off High-Interest Debt. Few investments pay as well as paying off high-interest debt on credit cards or other loans. You should also take steps to improve. If not, now is the time to make a plan to begin saving for that emergency. Sometimes, it's hard to imagine where you might find money to save. Start by. While you could simply add that cash to your savings for short-term goals, now may be the time to consider investing for longer-term goals by buying individual. Automate Becoming Wealthy. When I hired my financial advisor, that was an investment. It cost me money and time. That investment also provided. Pick the right mix of investments at the right time. Generally, the younger you are, the more money you can put in riskier investments because you have more. No one can guarantee that you'll make money from investments you make. But if you get the facts about sav- ing and investing and follow through with an. The national bestseller. Anyone can learn to invest wisely with this bestselling investment system! Through every type of market, William J. O'Neil's. You should not use or rely on this article in making any investment decision. HSBC is not responsible for such use or reliance by you. Any market. Yes a regular person can become wealthy and have millions of dollars from trading stocks. No, you should not do it the fast way. The best method. The second is through investment appreciation, aka, capital gains. When your investment appreciates, it increases in value. Give me a simple example. Let's say. Peer-to-peer lending is a hot investment strategy these days. While you might not get rich investing in a peer-to-peer lending network, you could definitely. If markets are trending upward, it makes sense to implement a strategic asset allocation as soon as you can. History shows that investors taking such a risk. Have you ever wanted to invest in rental real estate without managing the property (and tenants) yourself? Well, now you can! An income generating asset such as. invest in growth, making them valuable in the long run. Armed with this knowledge, investors are better equipped to make informed decisions that could shape. Opening a savings account at your local bank will allow you to earn revenue from the interest your own money accrues over time. Depending on the type of account. This means that if things go well, high-risk investments can produce high returns. But if things go badly, you could lose all of the money you invested. And the. Investors buy shares and invest in assets in the hopes of making a profit in the future by either growing their assets or earning an income through dividends. Investing in real estate can be one of the best ways to accumulate wealth. Wealth grows through compounding, which means putting money into something on the.

How Does Spac Make Money

I'm curious what the incentive is for founders like Chamath, Ackman and Ranadivé to actually organise a SPAC sale and merger. The SPAC's investors will then raise money with intent to buy one or more companies within the next two years. If the SPAC doesn't buy any companies within two. How does a SPAC raise funds? A SPAC raises funds via an IPO. If the SPAC does not make an acquisition (deals made by SPACs are known as a reverse merger). When you purchase SPAC shares pre-merger, you get the stock of the blank-check firm. This usually launches around 10 dollars a share. SPACs look for institutional investors and underwriters before releasing their shares to the general public. The money that SPACs raise through an IPO is. SPACs typically have a two-year horizon to find a private company with which they can merge. If they do not find a deal, the SPAC dissolves and returns any. The purpose of a SPAC is to raise money through an IPO to acquire and merge with another company. A special purpose acquisition company (SPAC) doesnt have any. SPACs are listed and publicly traded, but they don't hold any operating assets. Rather, they raise cash into their company, have a set time period to find. Sponsoring a SPAC potentially provides with above average gains and returns. Sponsors are providing SPACs' pre-IPO sponsor capital. I'm curious what the incentive is for founders like Chamath, Ackman and Ranadivé to actually organise a SPAC sale and merger. The SPAC's investors will then raise money with intent to buy one or more companies within the next two years. If the SPAC doesn't buy any companies within two. How does a SPAC raise funds? A SPAC raises funds via an IPO. If the SPAC does not make an acquisition (deals made by SPACs are known as a reverse merger). When you purchase SPAC shares pre-merger, you get the stock of the blank-check firm. This usually launches around 10 dollars a share. SPACs look for institutional investors and underwriters before releasing their shares to the general public. The money that SPACs raise through an IPO is. SPACs typically have a two-year horizon to find a private company with which they can merge. If they do not find a deal, the SPAC dissolves and returns any. The purpose of a SPAC is to raise money through an IPO to acquire and merge with another company. A special purpose acquisition company (SPAC) doesnt have any. SPACs are listed and publicly traded, but they don't hold any operating assets. Rather, they raise cash into their company, have a set time period to find. Sponsoring a SPAC potentially provides with above average gains and returns. Sponsors are providing SPACs' pre-IPO sponsor capital.

On IPO, SPACs typically raise approximately 20 times of the funds provided by the SPAC sponsors. SPAC sponsor capital would be around USD 10 million. The SPAC itself goes public to raise money that will be used to acquire a private company that's ready for the public market. The acquisition turns a. Possibility of raising additional capital: SPAC sponsors will raise debt or PIPE (private investment in public equity) funding in addition to their original. SPACs raise money during their own IPO and then though additional raises from existing institutional investors or outside investors in a PIPE (Private. They initially pony up a nominal amount of investor capital – usually as little as $25, – for which they will receive "founder shares" that often equate to a. Most SPAC IPOs are done at $10 a share, and you get one share and a warrant to buy more stock at a fixed price. That is usually $ for a specified time. The warrants generally do not become exercisable until the later of (i) 30 days after the acquisition or business combination by the SPAC or (ii) 12 months from. SPAC shareholders must vote to approve the acquisition deal too, and then they have two choices: either redeem their SPAC stocks and get their money back or. This SPAC then uses the cash proceeds from the IPO and a large stock issuance to acquire a private company, making it public. Since the SPAC issues so much. If the SPAC is successful, the price should appreciate, and investors will make money. So, how does an investor determine whether to invest in a SPAC? If the SPAC is successful in acquiring a target company, the founders will profit from their stake in the new company, usually 20% of the common stock, while. A SPAC is a publicly traded shell company that has a boat-load of cash and one purpose: to merge with a private company, effectively taking it public. For example, if the shares rise to a level of USD$16, each share resulting from an executed warrant would yield a profit of USD$, being sponsors' additional. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition. The SPAC then identifies and negotiates a business combination with a private company, swapping the cash it raised via its initial public offering (IPO) and its. The sole purpose of a SPAC is to raise capital through an IPO in order to merge with or acquire a private company. There is typically a 2-year deadline for an. A sponsor, often a financial institution, creates a SPAC, listing it on the stock market to raise money from public investors. The objective is to find a. Possibility of raising additional capital: SPAC sponsors will raise debt or PIPE (private investment in public equity) funding in addition to their original. Once the SPAC IPO is priced and funded, unlike a traditional public offering, the company does not get the cash. The proceeds are placed into a trust account. A SPAC will go public and list on a stock exchange, raising money from investors and institutions. At this stage, the SPAC still doesn't do anything, but it now.

Analyze Nyse Data

Quickly export data from NYSE's Amazon S3 to their own environment and start analyzing it with Amazon Athena and Amazon Redshift, build machine learning models. When investors hear the term “stock analysis,” they might picture an MBA at an investment bank, working hour weeks poring over quantitative data. In this project we will analyze real life data from the New York Stock Exchange. You will be drawing a subset of a large dataset provided by Kaggle that. The latest news and updates on the stock market today. Get up to speed with overnight summaries, stock market updates, and pre-open stock analysis of the. Join Seeking Alpha, the largest investing community in the world. Get stock market news and analysis, investing ideas, earnings calls, charts and portfolio. Stock analysis helps traders to gain an insight into the economy, stock market, or securities. It involves studying the past and present market data and. Data-driven insights from our trading systems and thoughts on key market structure topics. We and these third parties use cookies and the information collected to enable certain website features and functionality, analyze, and improve website. View Project-analyze NYSE sites-crimea.ru from AA 1Project: Analyze Nsye data Q1: How did pharma companies perform compared to all other companies and which I the. Quickly export data from NYSE's Amazon S3 to their own environment and start analyzing it with Amazon Athena and Amazon Redshift, build machine learning models. When investors hear the term “stock analysis,” they might picture an MBA at an investment bank, working hour weeks poring over quantitative data. In this project we will analyze real life data from the New York Stock Exchange. You will be drawing a subset of a large dataset provided by Kaggle that. The latest news and updates on the stock market today. Get up to speed with overnight summaries, stock market updates, and pre-open stock analysis of the. Join Seeking Alpha, the largest investing community in the world. Get stock market news and analysis, investing ideas, earnings calls, charts and portfolio. Stock analysis helps traders to gain an insight into the economy, stock market, or securities. It involves studying the past and present market data and. Data-driven insights from our trading systems and thoughts on key market structure topics. We and these third parties use cookies and the information collected to enable certain website features and functionality, analyze, and improve website. View Project-analyze NYSE sites-crimea.ru from AA 1Project: Analyze Nsye data Q1: How did pharma companies perform compared to all other companies and which I the.

This includes Google Sheets, Microsoft Excel, etc. Why this Project? This project will introduce you to the data analysis process that you will be using. Analyzing Stock Market Data with R We'll call multiple symbols at once by creating a vector of symbols and then pass the basket to the getSymbols function. You can get stock and geographic data in Excel. It's as easy as typing text into a cell, and converting it to the Stocks data type, or the Geography data type. data API documentation. Fin the most accurate stock market Our Commitment of Traders Report tool makes it easy to access and analyze this valuable data. Market Data & Connectivity. We source unique trading and settlement data directly from our markets, design and calculate today's most relevant indices, and. We and these third parties use cookies and the information collected to enable certain website features and functionality, analyze, and improve website. NYSE Technologies and SMA to Distribute Social Media Analysis Data via SFTI. Page 1 of 2 file:///Users/as/Desktop/SMA/Sales%20Folder%/NYSE%20Tech. Exchange Market Data Revenue Analysis. In , the total market data revenue for all U.S. exchanges combined was $ billion (including all asset classes and. Project: Analyze NYSE Data. In this project, you will use a data set containing financial performance data from companies listed in NYSE S&P to create an. ➤ Significantly extends the breadth and depth of data available from Google Finance ™️ ✓ 30 + years of all Historical Financials (Annual and Quarterly) Income. Analyzing the NYSE Data for the “Soft Drinks” GCIS Sub Industry to Understand Financial Performance from to This dataset is a playground for fundamental and technical analysis Most of data spans from to the end , for companies new on stock market date range. Data and Analytics to Support Your IR Program. Training Videos · Register Now Analyze Real-Time Prices. Get a unified view of best bid/offer and trades. Weigend (), IEEE Transactions on Neural Networks 9(1): from ISLP import load_data NYSE = load_data. data feeds for the markets that it operates (NYSE, NYSE NYSE American analyze, and improve website performance, personalize user experiences, and. Real-time market data feeds cover the various asset classes and markets in the NYSE Group to offer you insight into intraday trading activity. LSEG Quantitative Analytics – a powerful, scalable platform to manage, maintain and integrate quantitative analysis and investment data. It is available. The most powerful stock market add-on for Google Sheets. Real-time and 30+ years of historical price data, fundamentals, analyst ratings, dividends, options. NYSE TAQ products provide a comprehensive historical end of day record of all data that was published by the NYSE Group Exchanges' real-time data feeds. Included in this report are the key fee changes for Nasdaq. UTP Plan core data as well as CTA core data and NYSE Proprietary data. Page 4. 3. C op y righ.

Travel Insurance For Trip To Costa Rica

As of April 1st , vaccinated and unvaccinated travellers do not need to show proof of medical and Covid-related Travel Insurance to enter Costa Rica. Whilst. Comprehensive travel insurance is an essential component of any well-planned trip. Book our Costa Rica Expert approved policies here. Travel LX Provides: · $, in primary medical coverage and covers COVID coverage just like for any other new sickness that occurs after the effective date. 1. Unvaccinated Tourists to Costa Rica Must Have COVID Travel Insurance. Tourists who are not fully vaccinated are required to purchase travel insurance for. Rincón de la Vieja National Park, Guanacaste Province, Costa Rica. Travel insurance for Costa Rica and beyond. I'm going to. Please select, Africa. Protect yourself on your Costa Rica trip with Blue Cross travel insurance. Get a free quote and travel with peace of mind knowing you're covered. Costa Rica does not require travel insurance for visitors, although it is highly recommended to protect your finances in the event of an unexpected medical. Watching the costs that come with your Costa Rica trip? This plan lays the foundation with coverage for travel obstacles like trip delays, emergency medical. Travel insurance is not a legal requirement to enter Costa Rica. However, it's recommended as Costa Rica is a country filled with rainforests, and animal-borne. As of April 1st , vaccinated and unvaccinated travellers do not need to show proof of medical and Covid-related Travel Insurance to enter Costa Rica. Whilst. Comprehensive travel insurance is an essential component of any well-planned trip. Book our Costa Rica Expert approved policies here. Travel LX Provides: · $, in primary medical coverage and covers COVID coverage just like for any other new sickness that occurs after the effective date. 1. Unvaccinated Tourists to Costa Rica Must Have COVID Travel Insurance. Tourists who are not fully vaccinated are required to purchase travel insurance for. Rincón de la Vieja National Park, Guanacaste Province, Costa Rica. Travel insurance for Costa Rica and beyond. I'm going to. Please select, Africa. Protect yourself on your Costa Rica trip with Blue Cross travel insurance. Get a free quote and travel with peace of mind knowing you're covered. Costa Rica does not require travel insurance for visitors, although it is highly recommended to protect your finances in the event of an unexpected medical. Watching the costs that come with your Costa Rica trip? This plan lays the foundation with coverage for travel obstacles like trip delays, emergency medical. Travel insurance is not a legal requirement to enter Costa Rica. However, it's recommended as Costa Rica is a country filled with rainforests, and animal-borne.

The GlobeHopper Senior plan is very popular since it provides coverage of $1 million up to the age of 79 years and $, for travelers more than 80 years old. I'm assuming you mean car rental insurance since that's the tag. Liability insurance is mandatory in Costa Rica. You can use your credit card. Covid insurance is required to visit Costa Rica. In addition travel insurance or trip cancellation insurance helps reduce the out of pocket costs of. CALL THE COSTA RICA SPECIALISTS · Protecting Your Travel Experience · Now that you have booked your trip, we wanted to remind you of the importance of travel. Travel Guard offers comprehensive and customizable travel insurance plans for travelers heading to Costa Rica. With excellent coverage and specialized emergency. Travel insurance for Costa Rica has been optional since March 31, The immigration officials in Costa Rica won't ask you to present proof of insurance to. Our Costa Rica travel insurance gives you protection for potential medical costs and flights delays, as well as cover if your luggage is lost, stolen, delayed. No, travel insurance is not currently required to visit Costa Rica. 4. What is needed to visit Costa Rica from the USA? If you're visiting Costa Rica from the. Personally I never use travel insurance when I go to Costa Rica. r/costarica · Costa Rica 2 week trip. r/costarica - Costa Rica 2 week trip. To enter Costa Rica, you'll need to fill in a Health Pass 72 hours before you arrive and show proof of travel insurance. That's where World Nomads comes in -. Do I need travel insurance to enter Costa Rica? Visitors to Costa Rica may need to show proof of travel insurance coverage before entering the country. Travelers with U.S. passports have uniformly reported receiving the lowest prices and best service from Trawick International. Some have paid less than $ a. No, as of April 1, , travel insurance is no longer required to visit Costa Rica. With that said, travel experts strongly recommend that anyone heading to. Insurer Sagicor Costa Rica offers travel insurance for Costa Ricans and residents who wish to travel abroad. Medical expenses and hospital benefit · Personal accident and liability · Cancelling and cutting short your holiday · Abandoning your trip · Delayed departure. The price of Travel Insurance varies by policy and by the age and health of those insured. Policies range from around $ a month to $1, or more per month. Costa Rica travel insurance is the same as standard international insurance, except it stands out in terms of its competitive pricing and comprehensive coverage. If you have a general question about travel insurance for your trip to Costa Rica, you can contact us by email at info(at)twoweeksincostarica(dot)com. For. Atlas Journey® travel insurance may be the best Costa Rica travel insurance for individuals and families alike looking for the necessary travel and medical. This plan is designed for those who are looking for the highest available benefit limits to protect your trip, see highlights below. Safe Travels Voyager.